The DFS Lab Chatbot team is a collaboration between Vessels Tech, Teller, and Ker-twang. We’re a team of developers and designers supported by DFS Lab to demonstrate the potential of chatbots for financial inclusion.

We recently ran a field demonstration at the UNCDF Learning Event in Dakar, Senegal, to showcase how chatbots can be an effective channel to reach low-income people and improve participation in the digital economy.

We set out to build a chatbot for recipients of Senegal’s government-to-person (G2P) assistance program, the Bourse Familiale. Because our goal was to showcase how chatbots can drive financial inclusion for even the poorest, most difficult-to-reach people, many of the constraints we faced were exactly the sort we’re looking for:

Bourse beneficiaries are largely illiterate, they live in rural or semi-rural settings, and most have access to only basic phones, not smartphones.

One constraint we could have done without was that we didn’t have a chance to speak directly with Bourse beneficiaries or test a prototype with them before the event. Usually we wouldn’t think of building a chatbot without first speaking with the people it’s intended to serve. But the timeline precluded direct conversations with beneficiaries and the workshop was explicitly intended as a learning event for UNCDF participants — the bot’s inevitable shortcomings would serve as an opportunity to explore and discuss what features a successful Bourse Familiale chatbot would require.

The Bourse Familiale is a social assistance program provided by the Senegalese government to reduce extreme poverty and promote the development of human capital. It provides beneficiaries with a quarterly payment of 25,000 XOF (~38€ or 43US$), conditional upon children being vaccinated and enrolled in school.

Our goal for the workshop was twofold: 1) to develop a chatbot prototype that would be useful to Bourse Familiale beneficiaries, and 2) to expose UNCDF conference participants to the many possibilities of chatbots and how they might be used in their own work.

The Bourse Familiale Chatbot

Until recently, Bourse Familiale payments were made in cash and beneficiaries had to go collect their payment in person. As Bourse Familiale transitions to digital distribution of payments via mobile money, there are a number of challenges and opportunities. As with any group that is new to mobile money — especially a group in which people struggle with literacy and numeracy, have limited comfort with cell phones, and are new to digital finance — using mobile money is not always straightforward.

Based on our work in Tanzania and conversations with digital finance experts in Senegal, we decided to test a voice-based mobile money notification and education system. Currently, Bourse recipients only receive an auto-generated text message from the mobile money operator (Orange) when their payment arrives. We experimented with sending beneficiaries a voice notification about their payment in their local language, Wolof, along with interactive information about using mobile money and other financial confidence-building topics.

2. The UNCDF Bus Ride Bot

The UNCDF field visit took place in Thiès, a city about an hour’s drive from Dakar. We decided to use the time on the bus to let the conference participants interact with another type of chatbot, this one geared specifically to them. The UNCDF Bus Ride Bot was offered via Facebook Messenger in French and English and walked participants through the activities they would be participating in upon arriving in Thiès. It let users explore more about chatbots and explained their individual roles and responsibilities during the field exercise. On the bus ride back it also prompted participants to reflect on and record their findings.

The Bourse Familiale bot was an extension of our initial prototype in Tanzania. Both were built upon the Twilio, a cloud API for phone calls and SMS. Using Twilio’s Programmable Voice, we built an IVR system that played audio messages from our server and routed users to different messages using their phone’s number pad.

Unfortunately, as is the case in Tanzania, Twilio doesn’t offer a local number with which to receive calls in Senegal, so the only way to interact with these beneficiaries was by sending outbound calls from an international number.

The Bus Ride bot was built using a combination of DialogFlow, Google’s bot building framework, and Firebase, an app building platform. This combination enabled us to build a reliable bot quickly, while also handling some tricky logic that DialogFlow can’t handle on its own. Conference participants communicated with the bot over Facebook Messenger on their iOS or Android devices.

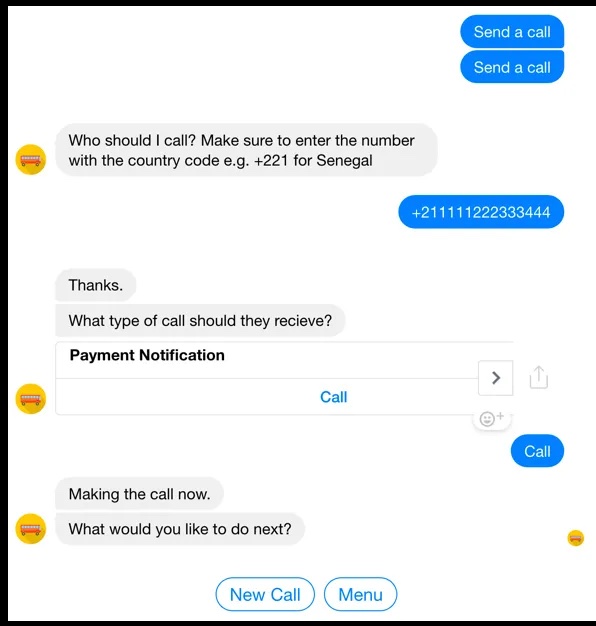

Because we could only send outbound calls from Twilio, we needed a way to trigger the call from the Bourse Familiale Chatbot to the beneficiary. We solved this problem by using the Bus Ride bot to communicate with the server of the beneficiary’s phone number and specify what type of call they should receive.

Both bots performed well given our time and design constraints, but we would have benefited from more time to iron out a few design issues and make the Facebook bot less error prone. While the Facebook bot worked great for some conference participants, for others it sometimes got stuck or failed to deliver a response.

Literacy is an obstacle but not a roadblock. A majority of the Bourse Familiale recipients were illiterate, but when they receive a payment notification by text message they can still decipher the amount by looking at just the numbers or by asking a literate family member for help. When Bourse payments are disbursed word also spreads throughout the community. Consequently, text messages may work for simple notifications, but not for education.

Voice notifications have pros & cons. Voice messages can be easier to understand than text messages for those who are illiterate; they can also feel more personal and be more private. But voice calls need to be supplemented with a lasting record of the payment, e.g., in the form of a text message.

Pull > push. Recipients don’t always have their phones on; some even receive payments on a family member’s phone. It would be beneficial if people can hear notifications or educational content on demand. A phone call may come at an inopportune time; it’s also more likely to be answered if it has a Sender ID name (e.g., Orange or Bourse Familiale), rather than an unknown phone number.

Better customer service is achievable. Beneficiaries are not accustomed to receiving customer communications that feel geared to them — e.g., in their native language and tailored to their level of comfort with mobile money/mobile phones.

Education and customer service are exciting use cases for chatbots. Interactive voice-based content on key topics would provide a more user-friendly and effective way to engage a difficult-to-reach customer segment.